A Trillion-Dollar Opportunity Unleashed by a Phone:

How Fintech is Reshaping Africa’s Microeconomy

For those who have never been to Kenya, it might be hard to imagine that in this distant East African country, people can handle almost all daily payments, transfers, and even loans with just a mobile phone. Behind this lies a booming market with immense potential, offering investment opportunities worthy of attention from Chinese investors.

Image from AFP via Getty Images

01

Microeconomy Takes the Lead

Kenya’s economic vitality stems from its vast small and medium-sized enterprise (SME) sector. According to data from the Kenya National Bureau of Statistics (KNBS), SMEs provide over 80% of employment in Kenya and contribute about 40% of the country’s GDP[1]. These small shops and street vendors form the backbone of Kenya’s economy and are key to social stability.

However, traditional banks’ high barriers, complex procedures, and collateral requirements have long excluded these SMEs—the ones most in need of financial services—severely limiting their growth.

02

The Fintech Revolution:

Solving Big Problems with a Phone

Kenya’s financial inclusion miracle didn’t start with banks but took off from a small mobile phone. The famous mobile payment platform M-Pesa is at the heart of this. Since its launch in 2007, M-Pesa has evolved from a simple transfer tool into a “mobile bank” serving multiple countries.

The secret to M-Pesa’s success lies in its simplicity. Users only need a basic phone to top up their accounts with cash at roadside shops. Once topped up, they receive e-money, which can be traded using a phone PIN. This process bypasses expensive bank branches and complex approvals, bringing financial services to everyone. More importantly, Fintech platforms and institutions can leverage M-Pesa’s vast transaction data for credit assessments, enabling “unsecured loan” and truly breaking traditional finance’s exclusion of micro-entrepreneurs.

M-Pesa’s success is not an isolated case but a vivid example of how Fintech can transform grassroots economic vitality. It proves that technology-driven innovation can overcome traditional financial limitations, offering SMEs and ordinary users more efficient and inclusive services.

A Safaricom customer uses M-Pesa. image from file photo | nmg

03

Continuous Evolution of the

Innovation Ecosystem

Kenya’s Fintech innovation goes far beyond M-Pesa. Agricultural insurance tech company Pula Advisors uses satellite data and AI to provide weather index insurance, with automatic payouts to farmers’ e-wallets during disasters. The Fintech platform M-Kopa’s “rent-to-own” model allows users to build credit through small daily repayments, gradually qualifying for loans or insurance[2][3].Regional collaboration is also accelerating. Kenya’s participation in the Pan-African Payment and Settlement System (PAPSS) enables real-time local currency settlements, reducing reliance on the U.S. dollar[4]. Fintech is increasingly integrating with agriculture, credit, and cross-border trade, driving a more efficient and inclusive financial system. However, challenges like cybersecurity and privacy protection remain.

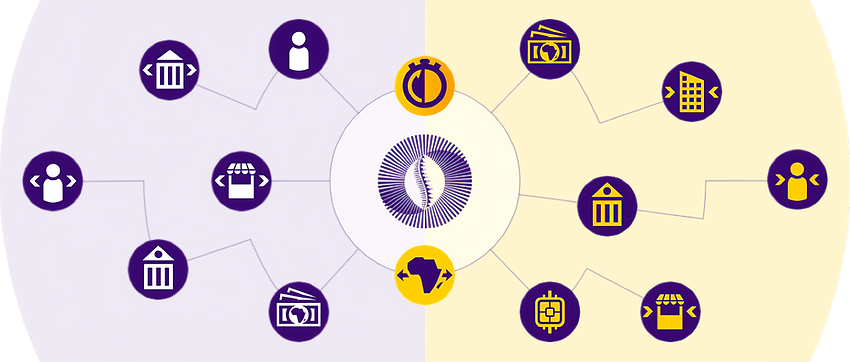

PAPSS Network | image from PAPSS.com

04

Prometheus:

Chinese Wisdom, African Practice

In this wave of Fintech empowering micro-entrepreneurs, Prometheus Tech is providing practical solutions for Kenya’s SMEs through technology and innovation.

Take the Coolinginn project as an example. It offers cold chain services to community vendors, adopting an innovative “service fee structure”—vendors only pay a small fixed fee based on the daily weight of refrigerated goods stored. This model combines PayGo IoT technology and installment payments, significantly reducing startup costs and operational burdens for rural entrepreneurs. At the same time, its self-developed ERP system automatically tracks data and generates precise bills, simplifying financial management for small businesses.

Prometheus’s model is deeply rooted in Africa’s needs, aiming to lower barriers to entrepreneurship, improve operational efficiency, and create sustainable livelihood opportunities.

05

Our Action:

Driving Dialogue and Collaboration

SME Spark Summit Workshop

With a deep understanding of Fintech’s power and challenges, Prometheus Tech is actively building bridges for industry dialogue. On July 18, 2025, we successfully co-hosted the “SME Spark Summit” workshop in Nairobi with Impact Hub Nairobi .The event brought together microfinance institutions, Fintech innovators, and ecosystem builders to discuss how smarter, more inclusive financial services can support SME growth. Highlights included:

Industry experts sharing behavioral credit scoring technologies and risk management tools

Real-world case studies showcasing community-driven trust-based lending models

A keynote speech by Prometheus Tech on leveraging technology for inclusive finance.

The event not only sparked new collaboration opportunities but also provided valuable insights into how Fintech can address grassroots economic challenges.

06

The Opportunity is Here

The Kenyan market, especially its vibrant microeconomy, is showcasing unprecedented opportunities. A mature mobile payment infrastructure and a continuously innovative Fintech ecosystem are effectively solving financial inclusion challenges and unlocking immense growth potential.

For Chinese investors seeking growth in emerging markets, Kenya’s story is highly compelling—a large market base, mature user habits, and innovative solutions addressing real pain points. Prometheus Tech’s local practices and industry events are vivid examples of this trend and active participation.

To focus on Kenya and Fintech’s empowerment of micro-entrepreneurs is to grasp the pulse of Africa’s future economy. We look forward to partnering with more visionary peers to explore the boundless possibilities of this dynamic land.

References

[1] KNBS MSME survey, 2016,https://www.knbs.or.ke/reports/kenya-micro-small-and-medium-enterprises-basic-report-2016/

[2] Time Journal, 2024, https://time.com/7023557/thomas-njeru/

[3]M-KOPA III solar home systems,2015, https://www.fsdkenya.org/thematic-areas/digital-finance/m-kopa-iii-solar-home-systems/

[4] Reuters, African payments system PAPSS plans to launch FX market platform this year, 2025 https://www.reuters.com/markets/currencies/african-payments-system-papss-plans-launch-fx-market-platform-this-year-2025-03-12/